You might be carrying out business with Al Ansari Balance Check. If so, you might need to check the balance often. Perhaps you are handling finances, carrying out a financial transaction, or simply handling finances in your own life. In any of these instances, it is important that you understand how to check the balance in your Al Ansari account. With our resource guide in mind, every detail about checking balance in Al Ansari will be examined.

Al Ansari Balance Check

Al Ansari is one of the most recognized brands when it comes to financial services, especially when you are sending finances abroad or when you want to have any sort of financial service delivered to you at a UAE level. However, balance checking is always the initial procedure when it comes to doing any sort of financial business or financial planning. By doing balance checking, one can always be considered as their own boss when it comes to finances.

However, the question is: just how do you check your balance on Al Ansari? Well, let’s consider all the possible ways you can do this.

- Check Al Ansari Card balance instantly

- Methods: SMS, mobile app, website, branch

- 24/7 access via Al Ansari Exchange App

- Free balance inquiry at branches

Readers Must Love It: Ratibi Card Salary Check

Why You Should Check Your Balance

- Monitor salary or transfer deposits

- Avoid overdraft or penalty charges

- Manage budget more accurately

- Confirm successful transactions

- Maintain financial control

Al Ansari Exchange Branches in the UAE

Dubai

- Mall of the Emirates 1 Branch

- Mall of the Emirates Metro Link Branch

- Mall of the Emirates 3 Branch

- The Dubai Mall 4 (At The Top) Branch

- The Dubai Mall 1 Branch

- The Dubai Mall 3 Branch

- Mirdif City Center Branch

- International City Branch

- Dubai Hills Mall Branch

- Al Nahda Twin Tower Branch

- Al Murooj Branch

- Carrefour Barsha Heights Branch

- Wafi Mall Branch

Sharjah

- Maliha Street – Industrial Area 15 Branch

- Al Khan Corniche the Gate Tower Branch

Abu Dhabi

- Abu Dhabi Mall Branch

- Many more branches exist in Abu Dhabi, Al Ain, Sharjah, Ajman, Ras Al Khaimah, Fujairah & Umm Al Quwain

Process To Know Al Ansari Exchange Rate: Complete Information

Solution 1: Al Ansari Mobile App Balance Check

The most convenient way that you can inquire about your balance would be through using the Al Ansari Mobile App. But if, as yet, you have not installed it in your mobile phone, then you can get it from your application store. Once installed, then you would follow these steps:

- Open App and Log In: You are asked to log in with your Username and Password.

- Access Balance Check Function: Once you have successfully logged in, you will be able to access the balance check function among other functions. This will be accessible via either the “Account” or “Services” tabs.

- View Your Balance: After clicking on it, your balance along with other information will be shown.

In case you experience some problems related to the application, ensure that the application is running with the latest update or everything related to the internet connection is in order.

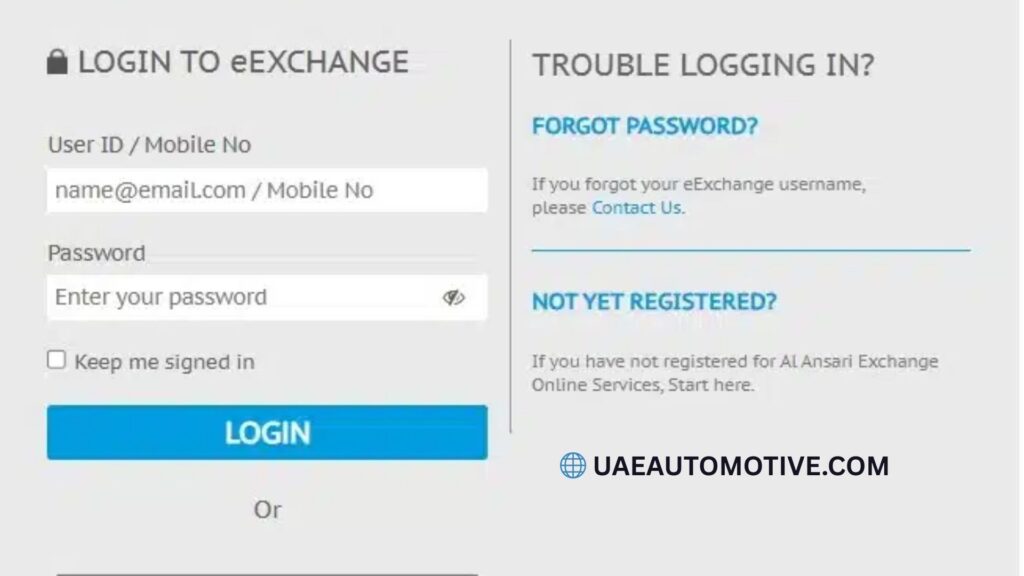

Solution 2: Utilizing the Website of Al-Ansari Exchange

You can also check your account balance through the Al Ansari website. Here’s how to do this:

- Accessing the Website: Use your computer web browser or internet browser from mobile phones to visit Al-Ansari website.

- Log In: You will log in using the username and password that you utilized in the mobile app.

- Find Balance Section: Look for ‘Balance Check’ under accounts/services.

- Your Balance: Now that you have been selected, you have a right to see your own balance.

This website will be most useful for those who would like to have a larger screen or those who have not yet downloaded the application on their gadget.

Solution 3: Checking Your Balance via ATM/Kiosk

You can check the balance yourself using an ATM or kiosk if you want to do so in this manner:

- Al Ansari ATM/Kiosk: Available in many locations in the UAE.

- Insert Your Card: The process involves inserting your card, as well as your PIN, and following directions from the ATM.

- Select Balance Inquiry: After having gained access to the account, select the “Balance Check” option from the menu.

In regards to operating an ATM, one must also take into consideration the environs within which these transactions are executed.

Solution 4: Contacting Al Ansari Customer Service

When you’re having a problem finding where you can see your balance or where you can go for an ATM that you can use to see your balance, you can call customer service. Here’s how you can handle the situation:

- Call Customer Support: Now, you need to contact the customer support services of Al Ansari by calling them using their contact number that is available on Al Ansari’s website or statement provided in your account statement.

- Your Details: You are required to provide your account number, as well as other details for purposes of identity confirmation.

- Balance Inquiry: Request that the customer service representative give you your balance.

It may serve as an alternative approved secondary source if no better options are available.

Before You Check Your Balance

It would have been advantageous to have known some details about the type of account offered by Al Ansari, aside from information concerning the representation of the balance for that account on the card.

Al Ansari usually provides personal and business accounts. Depending on the account, they will give you a different available balance, which will form part of your available balance and credit limit, if any.

Moreover, in balance inquiry transactions, you will be offered information regarding your transaction history, where you will be able to monitor deposits, withdrawals, as well as fees charged on your account.

- Keep your card/account number ready

- Ensure registered mobile number is active

- Check internet connection (app/website)

- Verify PIN or login details

- Use official Al Ansari channels only

Available vs. Current Balance: What’s the Difference?

| Aspect | Available Balance | Current Balance |

|---|

| Meaning | Amount you can use immediately | Total balance including pending transactions |

| Pending Transactions | Not included | Included |

| Card Payments | Reflected after settlement | Shown instantly |

| Withdrawals | Limited to this amount | May be higher than usable |

| Usage | Safe for spending & transfers | For account overview |

Why is My Al Ansari Balance Different from What I Expect?

There can be a number of reasons as to why you are seeing differences in your balance. The following are possibly what you should take note of:

- Pending Transactions: There could be pending transactions in the form of deposits/payments/transfers. These transactions could not be recorded immediately.

- Exchange Rate Fluctuations: Perhaps you are working with international exchange rates. Here, you might be concerned about the effect of exchange rates on the balance.

- Fees and Charges: A monthly fee or a maintenance fee might be applied, and some of these fees could be waived by deducting them from an outstanding balance.

- Security Holds: Recognizing that there is a suspicious activity alert/security hold on your account may also affect your balance.

For better clarification, one can check the transaction history for any update in the pending items.

Tips for Balance Monitoring

As a way to remain proactive concerning the monitoring of your account balances, the trick to prevent any steps being missed in handling finances is to use the following tips for monitoring your account at Al Ansari:

- Set Up Balance Alerts: Send notifications when a balance level is achieved via mobile app or internet services.

- Enable Push Notifications on Transactions: Receive notifications for every transaction that takes place on your account, helping detect unauthorized transactions early.

- Balance Review: Check the balance of your account every month to monitor discrepancies and spending.

Security Measures while Inquiring about Al Ansari Balance

When verifying your account balance for the Al Ansari bank account, it is important that you look at the security of your account first. The following are guidelines you must take into consideration:

- Strong Passwords: Ensure all passwords used for your Al Ansari account are different and strong.

- Secure Connections: Avoid public Wi-Fi and use secure networks.

- Two-Factor Authentication: Helps ensure your account remains secured against unauthentic login attempts.

Through the above measures, your financial details will be secured.

Al Ansari Balance Check Guarding Your Account from Fraud

- Detect unauthorized transactions early

- Identify suspicious balance changes

- Act fast to block compromised cards

- Keep records for dispute reporting

- Maintain account security awareness

How to Avoid Unnecessary Charges

- Check balance regularly

- Maintain minimum balance

- Avoid failed transactions

- Track fees and deductions

- Use official channels only

- Plan withdrawals carefully

- Avoid multiple small transactions

- Monitor SMS and app alerts

Al Ansari Balance Check for Businesses

- Monitor payroll and staff cards

- Track daily cash flow

- Avoid payment delays

- Verify bulk transfers

- Improve financial control

- Reconcile accounts faster

- Reduce operational errors

- Plan vendor payments

- Maintain audit readiness

Top Features of Al Ansari Exchange

- Fast international remittances – send money worldwide quickly

- Competitive exchange rates for currency conversion

- Mobile app with digital services (transfer, alerts, balance, history)

- Digital eKYC onboarding via facial recognition

- Extensive branch network across UAE

- Bill payments & value‑added services (top‑up, airline payment)

- Payroll and WPS salary solutions for individuals/businesses

- Real‑time transfer tracking and alerts

- Secure, regulated platform with fraud prevention

- Corporate services & bulk payments support

General Issues Related to Al Ansari Balance Check & Solutions

In most cases, there might be an issue in checking the account balance. Issues that can be observed in general, along with their solutions, include:

- Issues with App/Website: Ensure you have a stable internet connection or update the app.

- Imbalanced Balance Information: Check any pending or processed payments.

- Lock Outs: Change passwords if you have problems logging in. Inform support if issues persist.

Balance Check for International Transfers

If you have decided to make an international transfer, it is best to check your balance beforehand. Points to consider:

- Check Available Balance: Ensure sufficient funds before making the transfer.

- Currency Conversion: International transfers may affect your balance due to conversion rates.

- Fees for Transfers: Consider applicable fees which may reduce your balance.

Conclusion: Mastering Your Al Ansari Balance Check

It is very easy and fast to learn how to do an Al Ansari balance check! All this can be done by using the application, services available online at https://www.alansar.com/, using an ATM, or via customer services. By following each step strictly, anyone can easily monitor how finances are being managed. Common problems may also be resolved from this guide.

FAQs

Can we check our balance in Al Ansari without internet?

Yes, via ATM, kiosk, or customer services.

Why is my balance negative?

Pending transactions, unsettled payments, or other charges may cause a negative balance. Check your last transactions.

Can we check my Al Ansari balance in other currencies?

Yes, if you have accounts in other currencies, though exchange rates may impact balances.

Is it safe to check Al Ansari balance on public Wi-Fi?

No, always use secure networks for financial transactions.

What if there’s an imbalance in my account?

Check all recent transactions and contact customer services if needed.

Don’t Forget to Read It: Lulu Card Balance Check